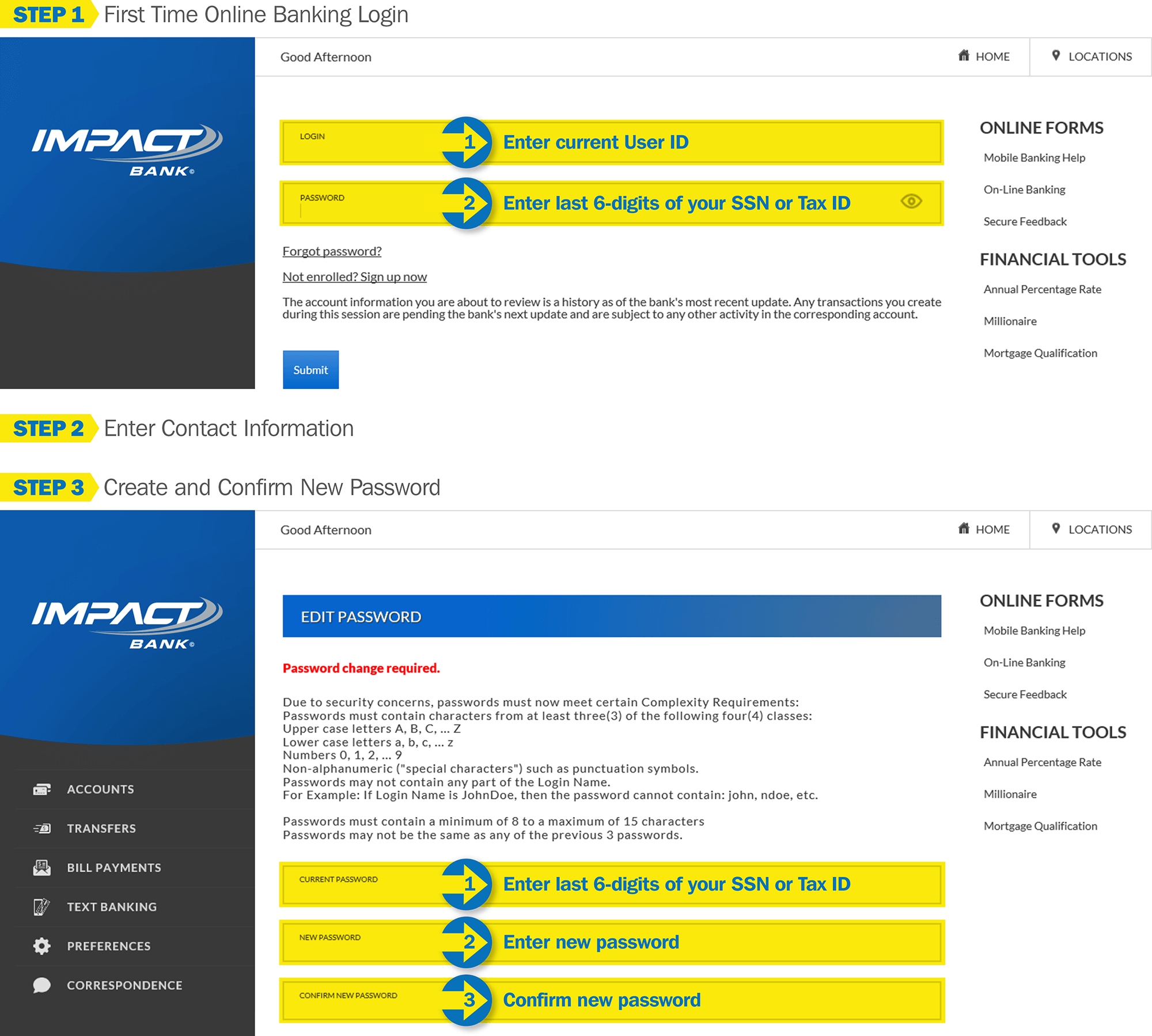

| MONDAY - OCTOBER 5TH LOGIN INSTRUCTIONS

- If you have bookmarked our login page on your computer browser or saved it as a favorite, you will need to delete your old bookmark or favorite and either do a search for our bank or type in www.impact-bank.com in your address bar and resave it as a favorite on October 5.

- The first time you log in to our new system you will continue to use your current Online Banking User ID, but your password will be the last 6 digits of your Social Security Number or Tax ID. You will be prompted to change your password during your initial login process.

Impact Bank System Upgrade

Begins at 5 p.m. Friday, October 2

Ends at 8 a.m. Monday, October 5

Impact Bank is performing a banking system upgrade to improve your overall banking experience, including our ability to offer new online and mobile banking capabilities.

Important Account Information >>

The system upgrade will affect the products and services we provide to you. We want you to be aware of these changes and ask that you read the following information carefully to help make the transition to the new system as smooth as possible. Debit Cards Your existing debit cards will continue to work during and after our system upgrade. Personal Identification Numbers (PINs) also remain unaffected.

- Beginning of Monday, October 5, Impact Bank will be able to instant-issue debit cards in the bank if your card is lost or compromised.

- More good news — your Impact Bank Debit Card will now be free. Impact Bank will no longer charge a $10 annual fee for a debit card.

Protect Your Debit Card

- If you have downloaded the SecureLOCK Equip™ mobile app to your phone, it will be discontinued at 5 p.m. on Friday, Oct. 2.

- The new data processor offers this protection service – there is no need for an extra app to monitor transactions with your existing debit card.

- You can manage your debit card through CARD ALERTS in eBanking. You will have the capability to turn the card on and off.

- You can set up alerts to be sent via text when these types of transactions trigger alerts: Minimum Transaction Amount, International, Online/Phone/Mail Order, Card Not Present, ATM Withdrawal, Decline, Cash Back, Credit, Reversal and Preauthorization.

Online Banking Online Banking will be unavailable from 5 p.m. on Friday, October 2, until Monday, October 5, at 8 a.m. The new Online Banking service will be accessible at www.impact-bank.com starting at 8 a.m. on Monday, October 5. Mobile Banking App The new Impact Bank Mobile Banking App will be available for download in the App Store (iPhone/iPad) and Google Play (Android) beginning October 5.

- The existing mobile app will no longer function after 5 p.m. on Friday, October 2. At that time, please delete it from your device to avoid confusion.

Mobile Deposit Mobile deposits will not be accepted beginning Monday, September 28, at 3 p.m. through Monday, October 5, at 8 a.m.

- On Monday, October 5, you will need to download the new mobile app and accept the new conditions prior to making mobile deposits.

Bill Pay Current bill payment information (payees and scheduled payments) will automatically convert to the new system.

- Any payments scheduled through Friday, October 2, will be processed using the current system. Payments scheduled on and after Monday, October 5, will automatically be processed using the new system.

- On Monday, October 5, we encourage you to review all your payees, amounts, and payment dates.

- Please contact us for assistance in cancelling payments or making other payment arrangements during the system upgrade.

- Beginning Monday, October 5 at 8 a.m. Peer-to-Peer (P2P) payments will be available. This service allows you to pay others electronically by entering their phone number and the dollar amount of the transaction.

E-Statements If you are already registered to receive e-statements you will not be required to re-register using the new system. All customers will receive a paper statement as part of the system upgrade.

- Please print or download and save all prior statements for future use. Previously generated monthly statements will not be available online after 5 p.m. Friday, October 2.

- Your new statement will not be available until your account statement cycle has occurred.

- You may register for e-statements beginning Monday, October 5, at 8 a.m. Upon registration you will receive an email notifying you when your statement is ready to view.

- If you choose to not receive e-statements, do nothing. You will continue to receive your statements in the mail.

Phone Banking (620) 326-3334 Phone banking will not be available beginning at 5 p.m. on Friday, October 2. Beginning Monday, October 5 at 8 a.m., you may call in to our phone banking system using your Social Security Number and date of birth. ATTENTION Intuit Product Users: QuickBooks®, Quicken®, TurboTax®, Mint® - If you are an Impact Bank customer and use any of these products in conjunction with your bank accounts, you will need to modify these software settings and account links prior to the upgrade to ensure the smooth transition of your data.

- On or before Friday, October 2, connect to Impact Bank Online Banking via QuickBooks to perform a final download/backup of your Web Connect file for all affected accounts. Once complete, disconnect all Impact Bank accounts from QuickBooks and other Intuit software programs.

- On Monday, October 5, at or after 8 a.m., please re-establish connections to these same accounts using the new Impact Bank Online Banking system.

Please click here for more information about downloading your transactions. Impact Bank is working to make this system upgrade as smooth as possible. If you have additional questions, please visit your local Impact Bank location, call Impact Bank in Caldwell at (620) 845-6444, and in Wellington at (620) 326-3361.

|

|